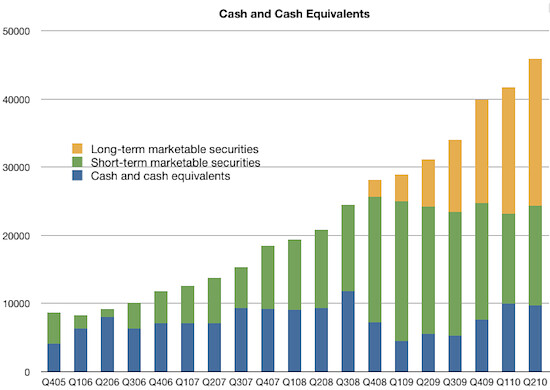

You know that scene from the opening of Duck Tales where Scrooge McDuck dives into a big ole’ pool filled to the brim with money and gold coins? Well, with over $46 billion in assorted securities to Apple’s name, you could easily build such a pool on Apple’s campus, fill it with money, and still have tens of billions of dollars left over to play with. The point is that Apple is currently sitting on a mountain full of cash, and folks are increasingly wondering what in the world Apple is planning to do with all that moolah.

Recently, Berstein Research analyst Toni Sacconaghi wrote an arguably self righteous open letter to Steve Jobs and Apple’s board of directors where he called on the company to reward shareholders with some of the loot in the form of dividends or a stock buyback. Incidentally, Apple hasn’t payed out a dividend since 1995.

According to Sacconaghi, investors, while pleased with Apple’s stock performance, share “one common source of frustration – which is now bordering on exasperation.” And that pesky little problem, so says Sacconaghi, is Apple’s ongoing refusal to issue a dividend.

Now you can argue the merits of issuing a dividend or initiating a stock buyback till the cows come, but this is an issue, as opposed to others, that Apple is willing to address head on. In fact, at the most recent shareholder meeting held this past February, Apple CEO Steve Jobs explained that Apple prefers to keep its money safely tucked away in the bank so that they can make “big bold” acquisitions when those opportunities arise. Apple, Jobs explained, wants to maintain its ability to purchase companies without first having to take out a loan, and subsequently put Apple at risk.

$46 billion, though, is a lot of dough, and let’s be real here – you really don’t need upwards of $50 billion to stay flexible. But at the end of the day, all you ask for, as an investor, is that earnings and the company share price continue to rise. So while a dividend may be nice, Apple’s perpetually rising stock price makes it hard to argue with their current strategy. The bulk of Apple’s money is safely stowed away in low yield but secure and long-term securities. It’s always going to be there. So for the time being, it might be a good idea to just sit back and let Apple do what it does best – engineer world class products that leave consumers satisfied and investors more than happy.

While it seems unlikely, or more like impossible, that Apple would ever burn through its entire stockpile of cash, there’s no denying that Apple is becoming a lot more acquisition happy as the company continues to expand. To wit, Apple over the past year has spent a few hundred million in acquisitions for companies specializing in mobile advertising, music streaming, and map technology. Going forward, the number of those acquisitions may very well increase, and though we unfortunately don’t know the feeling, we imagine that a few of those hundred million dollar purchases can start to add up real quick.

In the end, Apple’s share price should leave investors with little to complain about. Would a dividend be nice? Sure, but it’s hardly an “exasperating” situation.

chart via asymco

August 16th, 2010 at 3:30 pm

I guess the Sac personally went around asking each Apple shareholder how they felt about Apple’s $46 billion in the bank. I’m certain that he never asked me because I probably don’t hold enough shares to matter. I prefer a rising share price to a dividend but it looks like this year Apple’s share price rise is going to stall again and falter no matter how many products Apple sells. Of course, Apple can’t be blamed for that but I’m sure the hedge funds are behind the stall. The analysts keep goosing Apple’s target price closer to $400 and I believe all the analysts total up about a 1.25 Buy strength on Apple, but the darn stock refuses to move up and seems about as weak as any other tech stock.

I can only hope Steve finds some awesome company to snatch up that will give Apple some legs or hooks into the corporate world. Some company that might help dispel the rumors that the company will fail in a month or two and that the share price won’t drop to $150. I’m willing to trust Steve’s judgment over T. Sac’s judgment any day of the week.